Market Report: Q3 2024 Vancouver Office Figures (Members Only)

BOMA BC Review:

- Colliers Q3 2024 Vancouver Office Market Report

- CBRE Q3 2024 Canada Office Figures

- Cushman and Wakefield Q3 2024 Vancouver Office Report

- CRESA Q3 2024 Vancouver Office Report

- JLL Q3 2024 Vancouver Office Market

Highlights:

- Record slow leasing activity for Vancouver’s Third Quarter.

- Commercial real estate remains a tenant’s market in Metro Vancouver.

- Vacancy rates continue to climb.

Vancouver’s office market continues to adjust to new conditions. Right-sizing and flight-to-quality continue to persist as tenants continue to respond to new work environments. Landlords are in turn adjusting as well to maintain and recruit tenants.

Vacancy rates continue to hold steady.

While there were no noticeable improvements, market watchers agreed that the overall health of the market will turn a corner.

While market watchers remain optimistic, notable this quarter was the slow leasing activity.

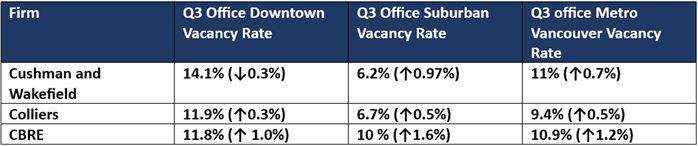

Vacancy Rates

Market watchers noted that vacancy rates continued to climb, or at least plateau, across Metro Vancouver this quarter.

While all market watchers agreed rates are rising, all had different reasons why:

- Cushman and Wakefield attributed this quarter’s uptick to significant new supply in Coquitlam and Burnaby. Cushman and Wakefield acknowledged, however, that flight to quality and continued downsizing could put upward pressure on vacancy rates.

- Colliers, on the other hand, noted that lower than normal deal activity contributed to rising rates.

- CBRE noted that flight to quality and tenant resizing continue to push vacancy rates higher.

Slow leasing activity, except for Class A

Several market watchers noted this was a notably slow quarter for leasing activity. JLL summarized the phenomenon by noting that “larger new office deals remain few and far between.”

There was a 35% decrease in leasing activity quarter over quarter. This is indicative that tenant demand is softening, according to Cushman and Wakefield.

Cushman and Wakefield also noted that there are very few, to no new entrants to the market.

Colliers agreed with other market watchers, stating that Q3 2024 was, “one of the slowest quarters on record both in terms of new supply and deal activity.” Colliers highlighted several issues contributing to slowing leasing activity this quarter, including escalating construction costs and permitting delays.

CRESA referred to this quarter’s leasing activity as an all-time low, and also highlighted how there were few new entrants to the market this quarter.

Flight to Quality bucks slow leasing trend

In previous market reports, we have often commented on the “flight to quality” trend, as tenants seek our higher class buildings in order to lure workers back to the office. The slow leasing activity this quarter did not apply to “Trophy buildings,” according to JLL.

“Leasing activity in the downtown core, especially in Class ‘A’ and Trophy buildings, has remained strong. Quarterly net absorption topped 200,000 s.f. in A/AAA buildings in the downtown core, while net absorption across Metro Vancouver for all classes was negative -127k s.f.” [1]

JLL also noted that,

“While larger new office deals remain few and far between, activity continues to improve in high quality assets and several notable deals were inked this quarter.” [2]

Tenant Preferences

Broader market conditions that have persisted since the pandemic continue to impact tenant preferences, and this continues to impact leasing deals and the commercial market.

In this current environment, tenants are looking for deals, and in turn, built-out spaces, forcing landlords to offer show suites.

“After facing increased calls for ready-to-occupy space, many landlords are now offering show suites, avoiding capex for tenants.” [3]

Colliers had a similar analysis, noting that in this current environment, tenants are looking for deals. They are also not as interested in unfinished space.

“…another challenge landlords and/or developers are facing is the hesitancy or resistance tenants have towards considering unfinished space…Difficulty visualizing what a space may look like, time to secure permits and complete fit-outs, and escalating construction costs are all hurdles to overcome.” [4]

Tenant preferences in this current environment are pushing tenants more towards the sublease market.

“Many prospective occupiers are leaning toward subleases due to their frequently lower cost deal and shorter lease terms, especially when factoring in the uncertainty surrounding the economic recession, fluctuating workplace occupancy levels, and rising construction costs.” [5]

Interestingly enough, landlords are also responding by offering tenant improvement packages or free rent.

According to CRESA, tenant inducements are having a major impact on leasing deals. “To get employees in the office, amenities such as a top-notch gym, showers, towels, an area for social gatherings are now part of the “must-have” list." [6]

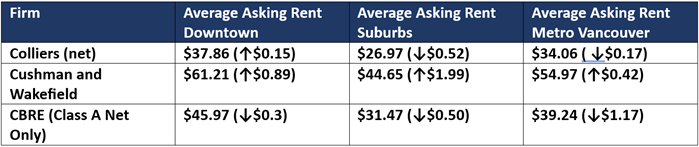

Asking Rates

Most market watchers acknowledged that asking rates remain elevated in Vancouver, despite challenging conditions. Cushman and Wakefield noted that rates are remaining resilient, and specifically singled out high-quality space for resilient asking rates.

Cushman and Wakefield attributed this to the addition of new construction, and higher priced direct vacant space.

However, Cushman and Wakefield noted that in order to combat softening market conditions and to maintain higher asking rates, landlords are offering tenant inducements.

Source links:

[1] JLL Q3 2024 Vancouver Office Market

[2] JLL Q3 2024 Vancouver Office Market

[3] CRESA Office Market Report

[4] Colliers, Q3 2024 Office Market Report

[5] Colliers, Q3 2024 Office Market Report

[6] CRESA Office Market Report