Market Report: Q2 2024 Vancouver Office Figures (Members Only)

BOMA BC Review:

- Colliers Q2 2024 Vancouver Office Market Report

- CBRE Q2 2024 Canada Office Figures

- Cushman and Wakefield Q2 2024 Vancouver Office Report

- NAI Commercial Q2 2024 Vancouver Office Report

Highlights:

- Vacancy rates remain elevated with little movement.

- It is a tenant’s market in Downtown Vancouver.

- Asking rates start to drop.

- Office to hotel conversions on the rise.

Vancouver’s office market continues to perform better than most major urban centres across Canada, but high vacancy rates continue to persist. While most market watchers noted this was a quiet quarter, trends are starting to emerge as a response to elevated vacancy rates – namely change of use and asking rates.

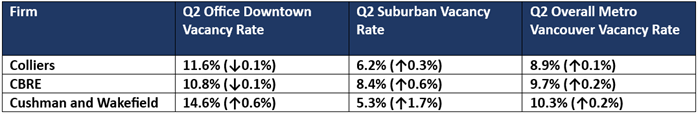

Vacancy Rates: Class C vs. Class A and Suburbs vs. Downtown

While overall Metro Vancouver vacancy rates increased slightly this quarter, most market watchers noted that they are starting to plateau. However, the data shows that the market continues to adjust to a new reality post pandemic of remote work and changing office needs.

Colliers had the most optimistic analysis, noting three consecutive quarters of declining vacancy rates downtown Vancouver, even if it was only minimal. Colliers attributed this to absorption of sub-lease space.

In previous market reports, we noted the gulf between the downtown and suburban markets, and changing dynamics. While overall, suburban vacancy has started to tick up, suburban markets remain stronger than the downtown core. Cushman and Wakefield noted rising asking rates in the suburb from elevated vacancy rates, and NAI Commercial highlighted how some pockets of the suburbs have healthy vacancy rates.

Cushman and Wakefield also specifically highlighted that while the downtown core is a tenant’s market, the suburban market is not.

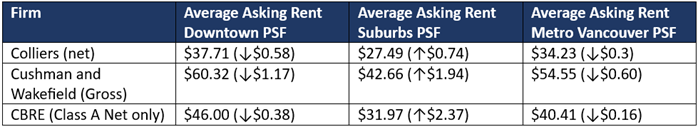

Asking Rates and a Tenant’s Market

Market watchers have noted that persistently high vacancy rates have started to impact asking rates in certain markets and are putting tenants in the driver’s seat.

Several of the past Quarterly Market reports noted asking rates were stubborn, and not dropping despite rising vacancy rates. Cushman and Wakefield noted this was attributable to newly constructed AAA class buildings skewing overall asking rates.

This quarter, Cushman Wakefield noted a moderate decrease of downtown rental rates by 2%, caused by persistently high vacancy rates.

Colliers also noted how challenging market conditions have put tenants in the driver’s seat

"Due to the downward pressure sublease options place on their headlease competition, tenants have the ability to negotiate rents and/or inducements with the landlords. Some headlease landlords will even consider offering turnkey and build-to-spec offices to attract tenants."

However, both Cushman and Wakefield also noted how landlords will offer tenant improvements to either maintain high rents or attract tenants.

NAI commercial also touched on this trend. According to NAI, landlords prefer to renew existing leases, rather than bringing on a new tenant. In order to bring on a new tenant, landlords may have to offer inducements or reduced rates.

"For example, tenants are renewing leases in Class A buildings at effective rents in the upper $30s to $40s, while in the same building, a landlord may offer inducements that nets an effective rent in the teens or low $20s. This demonstrates the value of tenant retention strategies and the increase in landlords’ building out ready-to-occupy suites.” [1]

Office Conversions

In previous market reports, we noted the increasing trend of office to residential conversions across Canada to address rising commercial vacancy rates. There has been far less uptick here in Vancouver, due to zoning, lack-of-incentives, and other factors. Office conversions have become quite popular in London, Ontario, for example.

While there has been less uptick of office to residential/hotel conversions in Vancouver, CBRE noted that this is because it may not be captured in the data.

According to CBRE, there have been a handful of “mid-construction,” conversions in Vancouver away from office to other uses.

Cushman and Wakefield also noted this trend. However, Cushman and Wakefield also added that this is not only because of high vacancy rates and reduced office demand, but also because of financing challenges.

"Currently, there is minimal interest in financing office projects…There is also a growing trend of converting proposed office developments into hotels or residential properties across Metro Vancouver as well as reducing their size or delaying them due to financing challenges." [2]

And according to Colliers, several new developments have been paused due to financing challenges, and overall reduced leasing activity in the market.

Source links:

[1] NAI Commercial Q2 2024

[2] Cushman and Wakefield Q2 2024 Office Market